Great Lakes Student Loans Higher Education, also well-termed as MyGreatLakes, is one of the state’s most popular student loan managers. Although Great Lakes does not offer consolidation or direct refinancing services, it is still possible to refinance loans by using the services of the MyGreatLakes. The big question that arises in the borrower’s mind is whether this financial step is a good idea or not.

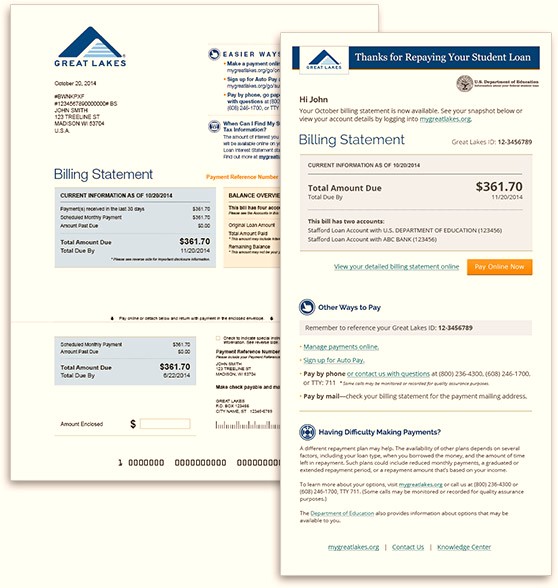

By using the MyGreatLakes online tools – the number of federal payment options increases to a great extent. Fortunately, Great Lakes is very well aware of the fact that borrowers may face a hard time while deciding the right payment option and have thus launched a payment planer to help them choose an option that suits the students.

With the payment planer, you can check the possible impact of all eligible programs for your loans, which includes changing the payment period and the interest paid. You can also access the discount provided by signing into your MyGreatLakes online account.

Start paying as soon as possible: Although paying off student loans at school is not your point at this age, it’s a good idea to think about it early. With the assistance of the MyGreatLakes, you can even pay at school, which is one of the most significant benefits of using this platform.

Excellent MyGreatLakes Customer Support– If you’re facing any sort of trouble or issue making your monthly payments or just want to discuss all your options with a professional, MyGreatLakes Customer Support is always ready and happy to help.

Plus, you don’t need to call or email for help every time as MyGreatLakes provides some excellent customer support via social media like Facebook and Twitter. This can be an excellent option in case, you want a quick answer to your query, but don’t have the time to make a phone call.